The Effect of Carbon Pricing on Canadian Households 1

The purpose of this blog post is to provide an estimate of the costs of different levels of carbon taxes on Canadian households, as a follow-up from testimony to the Senate Committee on February 16, 2017.2

Costs to Canadians as a result of carbon taxes will come in two forms, direct and indirect costs. Direct costs come from the levying of a carbon tax on emissions from energy used by households. Indirect costs come from the pass-through of costs from businesses to households. This note will provide an estimate of the costs to Canadian households by province and by fuel type, from a carbon tax on emissions associated with combustion of fossil fuels.

Canadian household energy use can be classified into three broad types: electricity, fuel for personal transportation (primarily gasoline and diesel), and natural gas and heating oil. The impact of carbon pricing on Canadian households will depend on the types of energy used by each household (for example, whether a household uses electricity, natural gas or heating oil for home heating), the emissions intensity of electricity in each province, and additional policies put in place by provincial governments to mitigate impacts.

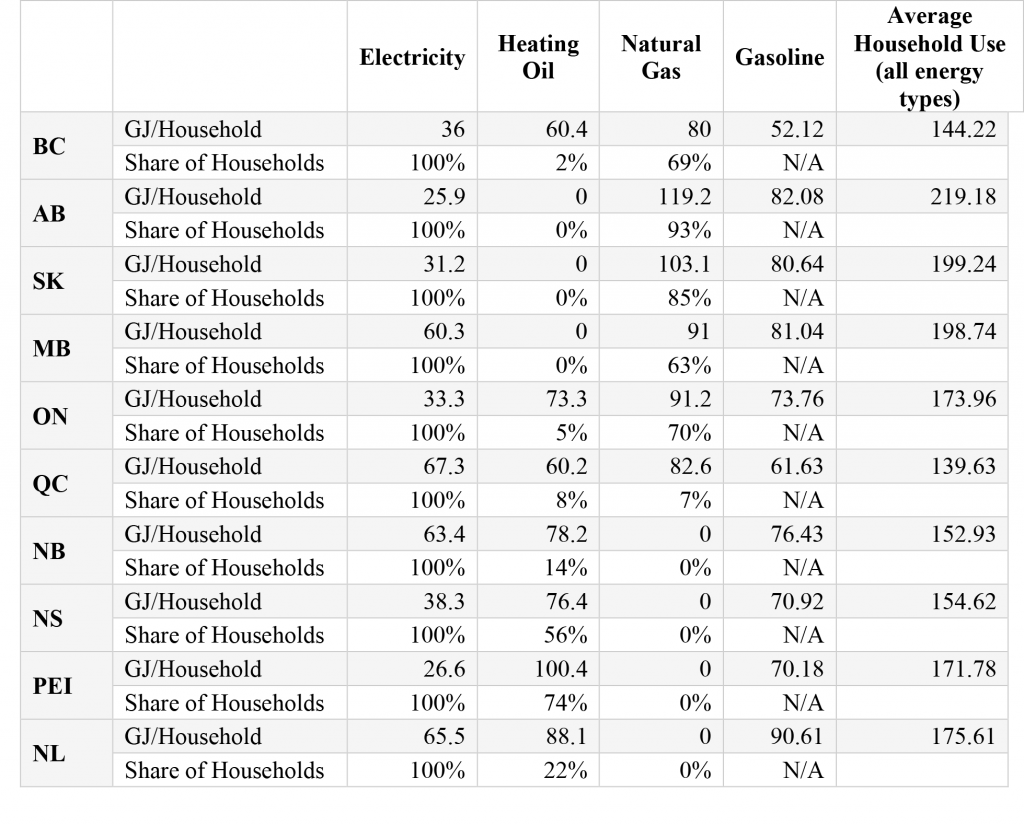

Table 1 displays Canadian household energy use, by province in 2013, reporting GJ per household for each energy source, as well as the share of households using each of electricity, heating oil and natural gas.3 Notably, all households use electricity, but some use heating oil or natural gas for home heating (the rest use electric heat). Provinces can be split into three groups: T hose that predominantly use heating oil for home heating (Nova Scotia and PEI), those that predominantly use natural gas (B.C., Alberta, Saskatchewan, Manitoba, Ontario), and those that use electricity (Quebec, New Brunswick, Newfoundland and Labrador). This will potentially have a large impact on the effects of carbon pricing on households, as electricity prices may or may not change as a result of carbon pricing.4 It also means that Canadians in provinces with relatively less emissions-intensive electricity grids, such as B.C., Quebec or Ontario, will face lower costs.

Table 1: Provincial Household Energy Use (GJ), 2013

Source: Author’s calculations from (1) Statistics Canada. Table 153-0161 – Household energy consumption, Canada and provinces, every 2 years, CANSIM (database); (2) Statistics Canada. Table 203-0021 – Survey of household spending (SHS), household spending, Canada, regions and provinces, annual (dollars), CANSIM (database); (3) Statistics Canada. Table 326-0009 – Average retail prices for gasoline and fuel oil, by urban centre, monthly (cents per litre), CANSIM (database).

Note: Some households use more than one type of energy, so that all households use electricity but only some use heating oil or natural gas. The numbers reported in the table for electricity, heating oil and natural gas are averages for households using that energy type. Gasoline use was imputed from average household expenditure on transportation fuels and provincial gasoline prices, and so is approximate.

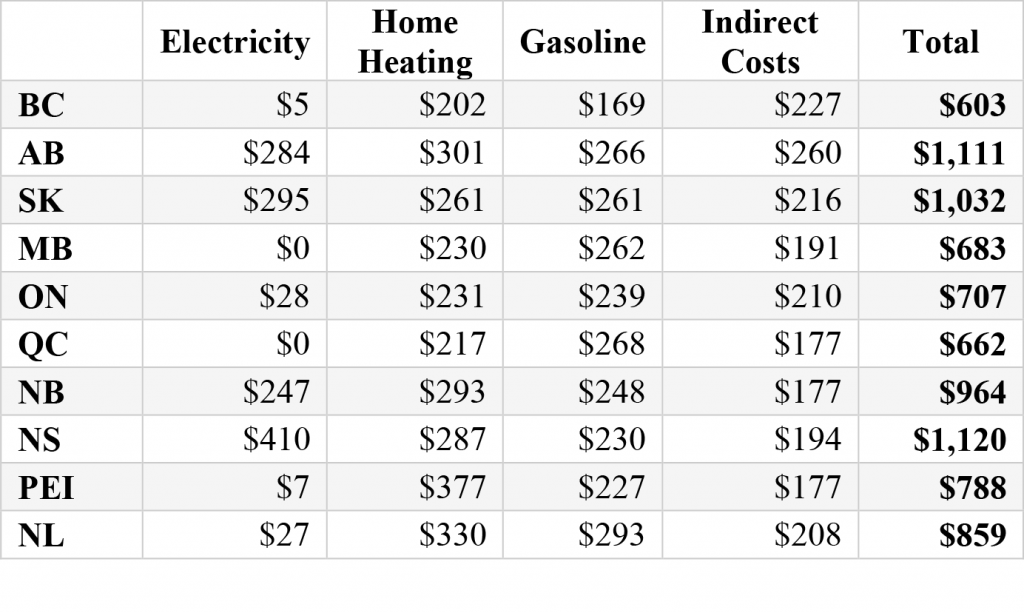

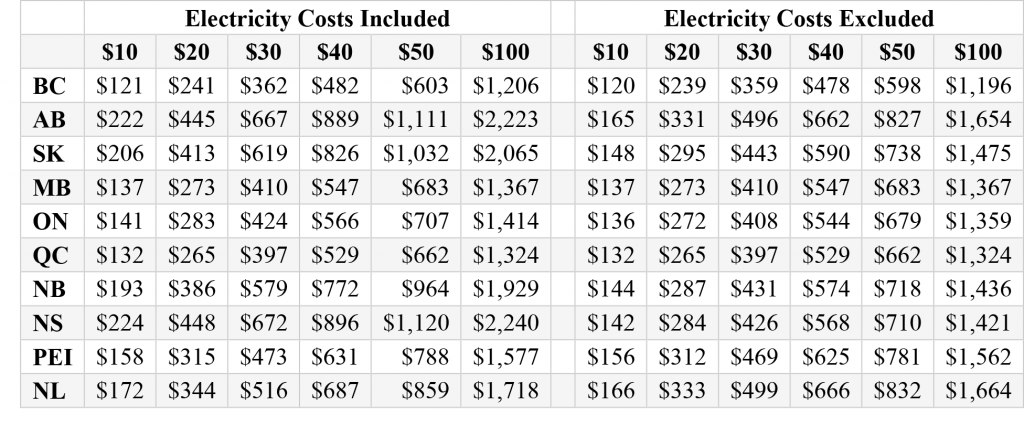

Table 2 displays estimated costs by province from a $50 per tonne carbon tax on fossil fuel combusion, based on 2013 energy consumption. Note that this reflects an upper bound for potential costs, as the estimates do not include behavioural changes that are expected in response to changing prices. The direct costs come from in-province combustion of fossil fuels. The indirect costs include in-province combustion by firms, as well as carbon tax costs from imports and exports of goods. Estimated costs range between $603 per household in B.C., to $1,120 in Nova Scotia. The largest variation in cost components is from electricity, with home heating, gasoline and indirect costs being fairly similar across provinces. However, as coal-based electricity is phased out, the carbon tax costs associated with electricity will decrease, lowering the burden on Canadian consumers. Similarly, should provincial governments enact policies to mitigate the impacts on electricity prices, this will also lower the burden on consumers. With electricity costs eliminated, the impact of the carbon tax ranges from $598 in B.C. to $832 in Newfoundland and Labrador, and has the potential to be even less for households with electric heating. Table 3 provides a comparison of the estimates of total costs (direct and indirect) at $10 to $100 per tonne, with and without electricity costs.

Table 2: Estimated Carbon Tax Costs for a Typical Household at $50/tonne

Source: Author’s calculations from (1) Statistics Canada. Table 153-0161 – Household energy consumption, Canada and provinces, every 2 years, CANSIM (database); (2) Statistics Canada. Table 203-0021 – Survey of household spending (SHS), household spending, Canada, regions and provinces, annual (dollars), CANSIM (database); (3) Statistics Canada. Table 326-0009 – Average retail prices for gasoline and fuel oil, by urban centre, monthly (cents per litre), CANSIM (database); (4) Bradford Griffin (2017), “Energy Use and Related Data: Canadian Electricity Generation Industry 1990 to 2015,” Canadian Industrial Energy End-use Data and Analysis Centre, Simon Fraser University; (5) National Energy Board website, “Energy Conversion Tables”; (6) Government of Alberta, Climate Leadership Implementation Act, 2016; (7) Statistics Canada’s Social Policy Simulation Database and Model v. 22.2.

Note: A “typical” household is constructed using the dominant home-heating source by share of population (see Table 1). Exceptions are Quebec, where the home heating cost is an average of household emissions from heating oil and natural gas, and Newfoundland and Labrador, where heating oil was used. Costs from electricity are overestimated as they include Canadians who use electricity for home heating. Indirect costs are estimated using the Statistics Canada’s Social Policy Simulation Database and Model; details available upon request.

Table 3: Estimated Carbon Tax Costs for a Typical Household at $10 to $50 per tonne

Source: See Table 2.

Note: Costs scale linearly.

1This blog post is based on a briefing note provided to the Senate Standing Committee on Energy, the Environment and Natural Resources. The briefing note was follow-up material after my testimony to the Committee on February 16, 2017.

2 The transcript of the testimony is available at https://sencanada.ca/en/Content/SEN/Committee/421/enev/21ev-53096-e. My opening remarks are also available at http://www.policyschool.ca/speaking-notes-senate-standing-committee-energy-environment-natural-resources/.

3Data on energy use in the territories is not available from Statistics Canada.

4 For example, Alberta is currently developing policies around output subsidies for large emitters, which includes electricity generation. These output subsidies mean facilities with emissions greater than 100,000 tonnes face a price per tonne of emissions produced, but receive a subsidy per unit of production based on their performance relative to others in their industry. This will lessen the impact of carbon pricing on consumers. In addition, Alberta’s government has introduced a price cap on electricity prices, which further reduces the impacts on consumers.