Today Marks the Beginning of the End for the Canadian Dairy Consumer!

The executive order by President Trump to pull the U.S out of the Trans-Pacific Partnership (TPP) marks the beginning of higher prices for dairy products in Canada. Canadian negotiators spent more than seven years and millions of dollars to be part of the agreement.

TPP presented a glimmer of hope for reforming the Canadian dairy industry. During the TPP trade negotiations, Canada agreed to increase foreign access to its dairy market. In addition, increased supply from the U.S. could have brought down retail dairy prices in Canada. Many policy makers saw this as the best opportunity to reform the outdated practices of supply management in the dairy industry.

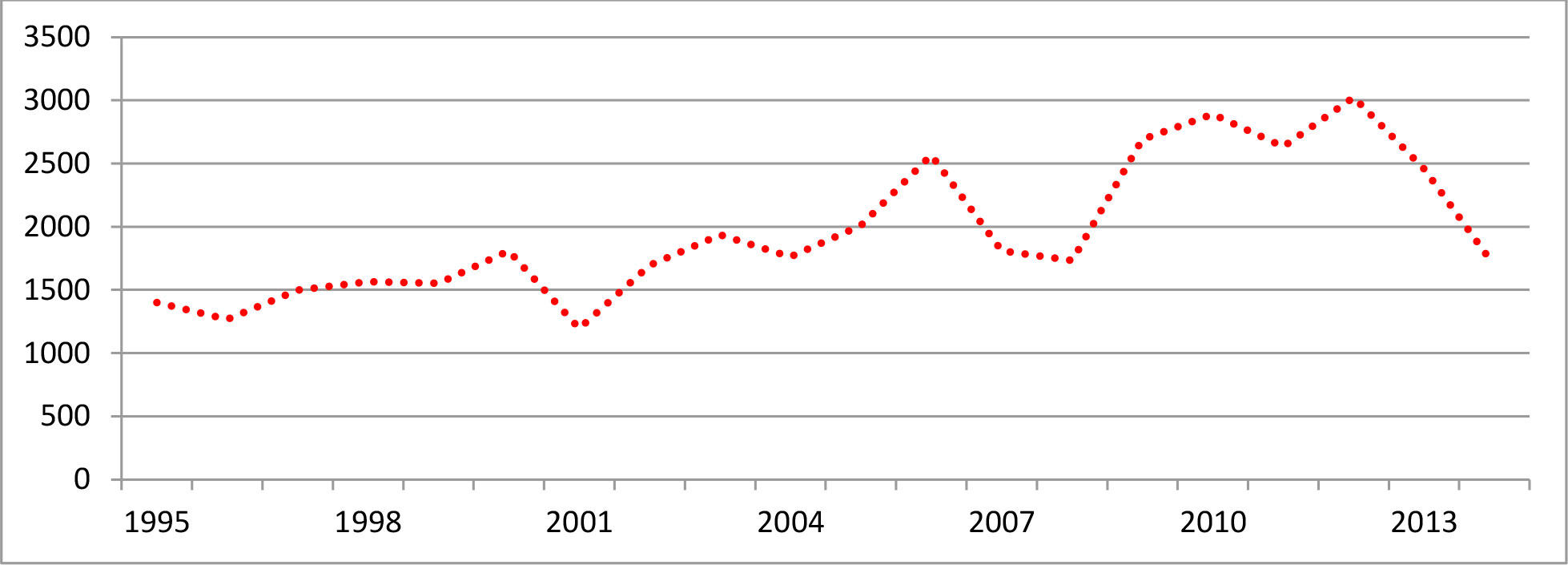

Supply management practices have a huge impact on the cost consumers pay for their dairy products. The Organisation for Economic Co-operation and Development (OECD) estimates that with supply management, dairy producers in Canada, on average, received CAD $2.5 Billion in support. This was the annual monetary value of gross transfer from consumer and taxpayer to milk producer, arising from the policies of supply management (see figure 1).

Figure 1. Support to Milk Producers in Canada (U.S. Millions of dollars), 1995-2014

Source: OECD, Agricultural support estimates (Edition 2015)

Canadian dairy producers have been protected domestically through supply management and internationally through import restrictions for over forty years. This combination of domestic and foreign policies have conspired to keep Canadian dairy prices artificially high, and have allowed producers to profit from the market while many consumers are punished.

The latest available figures show that Canada produced roughly 8.4 million tons of milk in 2013. This is a remarkably low level of milk production; it pales in comparison to Canada’s closest trading partner, the United States, which produced almost 10 times that amount the same year. Even Australia and New Zealand’s milk production was higher, with New Zealand producing twice as much dairy as Canada.

High prices in Canada matter. Canadians drink less milk on average than other comparable countries. Per capita consumption of milk in Canada has decreased from 81.5 litres in 2009 to 70.6 litres in 2015, a drop of 10 per cent in six years. In Australia and New Zealand, dairy sector reforms increased per capita milk consumption to levels well above both the U.S. and Canada. Lower prices mean more consumption. Supply management has resulted in lower Foreign Direct Investment to the Canadian dairy sector. Of the $21 billion invested globally into the dairy sector, Canada attracted a miniscule amount – less than one per cent.

With the TPP sinking, Canadian consumers will not see relief from high dairy prices. In fact with a low Canadian dollar and carbon taxes, consumers should brace for even higher prices.