What is the Alberta Advantage? Can it be Restored?

The term “Alberta Advantage” was popularized during the Klein government years, used so frequently it became like a mantra, but never clearly defined.

In a 2015 Edmonton Journal OpEd, Jack Mintz usefully described the Alberta Advantage: “No doubt, it is a combination of low taxes and good public services, especially education, health and infrastructure”. Low taxes and good public services are both highly desired by the public and politicians. If having low taxes and good public services at the same time is simply a policy decision, why doesn’t every province follow these policies?

Normally, achieving low taxes and good public services concurrently involves difficult trade-offs and compromises. In light of Premier Kenney’s stated intent to restore the Alberta Advantage, it is more important than ever to understand what has allowed Alberta to establish lower taxes while maintaining good public services.

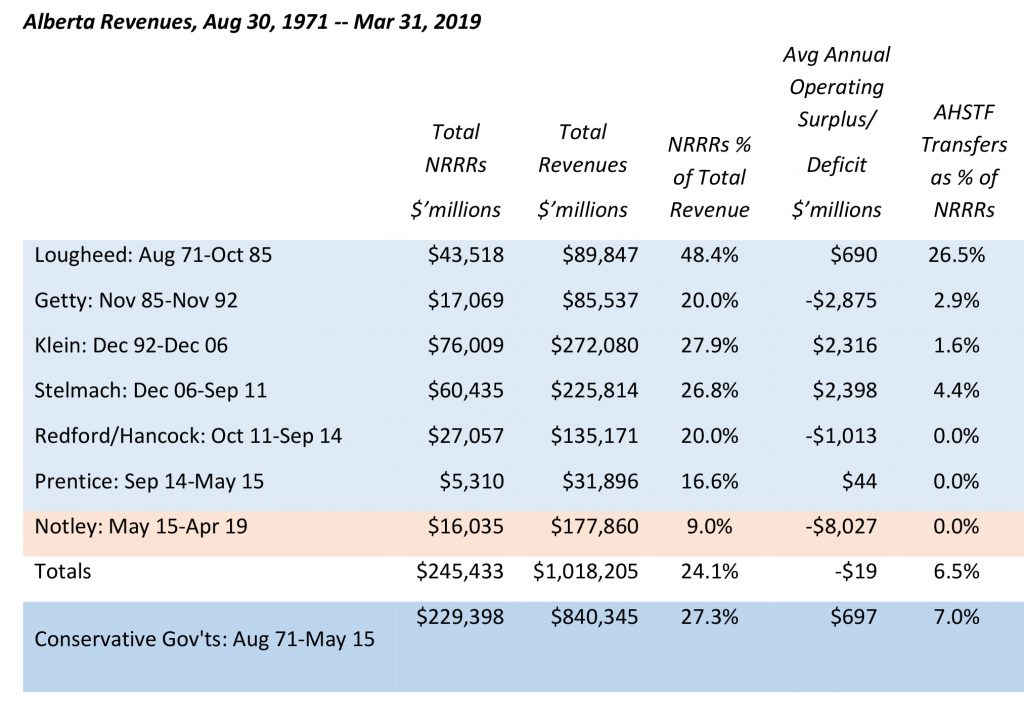

Alberta has had a unique revenue advantage among Canadian provinces, a large portion of its revenues coming from the province’s oil and gas resources (referred to as Non-Renewable Resource Revenues – NRRRs). I have prepared the following table based on data obtained from the Consolidated Financial Statements provided in Government of Alberta Annual Reports.

Notes:

1. Published data is by fiscal year; data for years in which leadership changed is pro-rated.

2. Premier Notley’s term extended to 16 Apr 2019; published data ends on Mar 31, 2019, so final 16 days of Notley’s term not included.

During 43.7 years of Conservative governments, NRRRs averaged 27.3% of total provincial government revenues. Even after transfers to the Alberta Heritage Savings Trust Fund (AHSTF), NRRRs represented over 25% of total revenues. These NRRRs gave Alberta a 25% revenue advantage, allowing taxpayers to pay only 75¢ of each dollar of the costs of public services provided by their government.Alberta’s revenue advantage has been volatile, depending on energy prices. Higher revenues occur when oil and/or gas prices are high, also generally coinciding with a boom in the Alberta economy. Lougheed experienced the largest share of NRRRs. Lougheed also increased royalty rates significantly (gradually eroded subsequently), lowered some tax rates modestly and established the AHSTF, to which he transferred 26.5% of NRRRs during his tenure as Premier.

Premier Klein’s tenure began with modest NRRRs, increasing by 2000 with strong natural gas prices followed by strong oil prices. The revenue advantage under later years of Klein’s premiership was almost as high as under Lougheed, resulting in modest transfers to the AHSTF. Increasing operating surpluses provided ample room for good program funding and significant reductions in taxes.

Alberta’s economic booms have always resulted from high oil and gas prices, not low tax rates. Lowering of taxes did not precede Alberta’s economic booms; they always occurred during booms when operating budgets have been in surplus. Lower taxes were rewards to Albertans, not a stimulus – like dividends to citizens when NRRRs are high. Embedding lower tax rates in the revenue structure resulted in semi-permanent “dividends” even though they may no longer be affordable when the boom subsides. The recent extended boom began to unravel as global oil prices collapsed towards the end of Premier Prentice’s term and have not recovered. During Premier Notley’s tenure, NRRRs declined to 9% of total revenue and resulted in substantial deficits despite modest increases in some tax rates.

Simply reinstating the lower tax rates enjoyed by Albertans during the boom years cannot restore the Alberta Advantage. Concurrent low taxes and good services were a consequence of wealth derived from Alberta’s oil and gas resources, not the cause of that wealth. Only another oil and/or gas boom can bring back the Alberta Advantage. Wide consensus on the unlikelihood of such recurrence means the Alberta Advantage has disappeared, likely permanently. In retrospect, many Albertans might have preferred a Norway-style advantage over the Alberta Advantage – Norway maintained its tax rates during its boom years and saved its NRRRs instead of distributing them as “tax dividends”. Today Norway has a savings fund valued in excess of $1.4 trillion ($Canadian) that will continue to pay dividends to Norwegians for many years.